irs tax levy on bank account

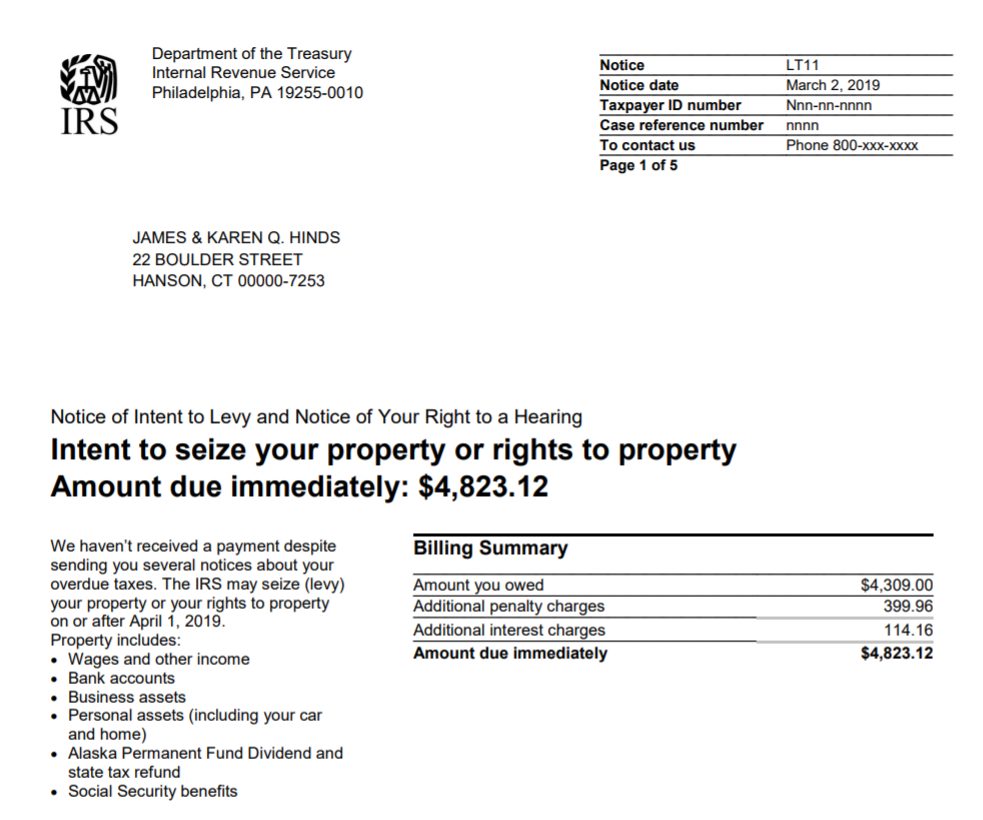

If you do not either pay the tax in full by the due date stated in the LT11 or call the IRS number on the LT11 before that date to resolve your tax problem the IRS could send an IRS bank levy to. An IRS bank levy.

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

We can have a quick chat on the phone so I can answer your questions and see if there is any way we can.

. The IRS can place a levy on your bank account to collect on your debt allowing it to take your funds. Contact the IRS immediately to resolve your tax liability and request a levy release. IRS Levies on Bank Accounts.

Your initial reaction should be to identify the source of the levy and to make sure that your account is indeed overdue. The generally used method that a levy is issued would be to freeze everything in your bank account. The IRS has the power to file a tax levy on your bank account which grants the agency access to that accounts funds upon filing.

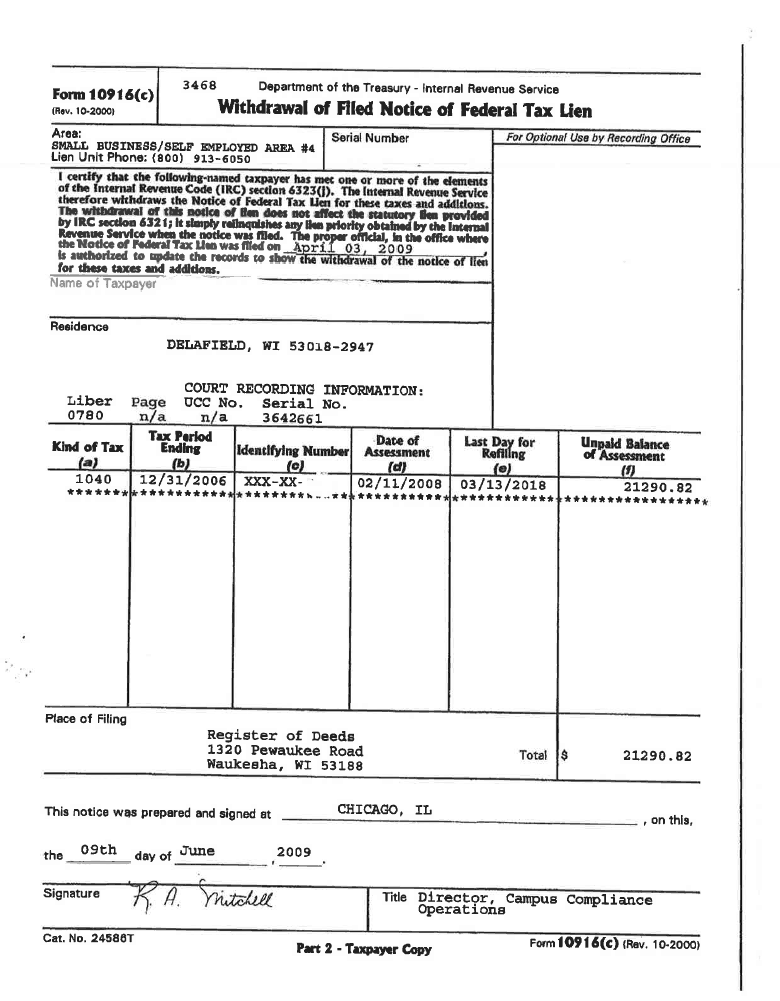

Most people that owe money for. The IRS serves a bank. This section discusses how the IRS administratively enforces the tax lien using its power to levy on and sell property of the taxpayer or property encumbered with a federal tax.

A IRS bank levy is a physical claim on an asset or fixed value of an account. The IRS sends levy to the banks that issued you a 1099. When the IRS issues a bank levy they are claiming the contents of your bank account to satisfy your.

There are also additional ways a levy can be. However an IRS levy against your business bank account is a very serious collection tactic and requires serious and immediate action. A tax levy is a process that the IRS and local governments use to collect the tax money that theyre owed.

A bank levy allows the IRS to legally seize any money a taxpayer has in any type of bank account. A bank levy will result in your. If the levy on your wages is creating an.

Income from Roth IRA and Roth. An IRS bank account levy is a type of tax levy that is when the IRS seizes money from your bank account to cover your taxes owed. Give us a call at 866 573-3755 today to talk to someone safe about your situation.

If the IRS has sent repeated notices demanding payment. Get help from a qualified tax. The IRS can also put a levy on your bank account which gives them the legal right to take the money you have in your account to pay your tax debt.

If the corporate veil is pierced and its not that hard to have it pierced if youre not careful - then they can treat it as if it is your personal asset. Contact the IRS at the telephone number on the levy or correspondence immediately and explain your financial situation. A tax levy on a bank account is typically a.

Then they levy up to the full amount of the tax balance due from your bank account. An IRS bank levy is when the IRS seizes the funds in your bank account to cover your back taxes. How to Resolve a Business Tax.

The IRS can also release a levy if it determines that the levy is causing an immediate economic. If the IRS places a tax levy on your bank you have 21 days. A bank levy is a one-time seizure of monies.

It applies only to the funds in your. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. Removal of IRS Levy.

The IRS can levy all funds in your account up to the full amount of the tax debt penalties and interest. The IRS can levy a bank account more than once. When the IRS levys you it is not a standing levy which means you can deposit money the next day.

Through a tax levy you may have money taken from your bank. This is recognized as a bank levy. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

The collected amount helps settle outstanding tax owed. If this was a mistake you can also file for lost funds. Call 877 500-4930 for a free consultation with our team.

The Irs Tax Levy 6 Ways Irs Uses Levies To Collect Taxes

3 17 277 Electronic Payments Internal Revenue Service

Irs Bank Account Levy Frequently Asked Questions Faqs

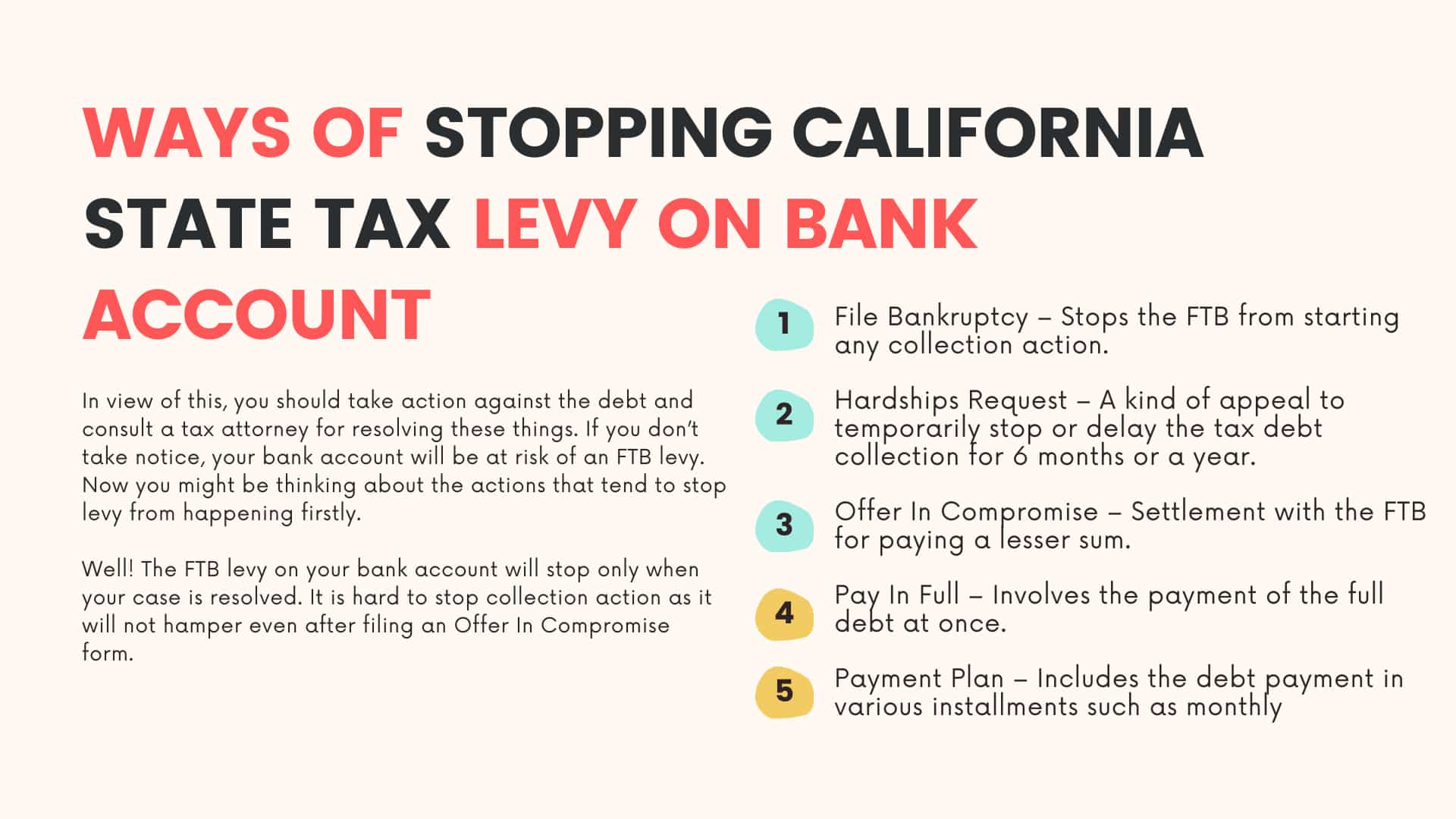

3 Proven Ways To Stop California State Tax Levy On Bank Account

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Tax Audit Help Stopping An Active Irs Levy Or Garnishment

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Can The Irs Levy A Joint Bank Account Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Notice Cp504b What It Means How To Respond Paladini Law

Will A Lien Or A Levy Affect My Credit Score Pittsburgh Irs Tax Relief Attorney

Are You Being Levied By The State Or The Irs

3 17 277 Electronic Payments Internal Revenue Service

3 Proven Ways To Stop California State Tax Levy On Bank Account

Irs Tax Levy Tax Law Offices Of David W Klasing

Irs Notice Cp91 Intent To Seize Social Security Benefits H R Block

Irs Took Money From My Bank Account Louisville Bankruptcy Lawyers

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm